By Megha Nagaswami, MA

You’ve worked hard to learn new skills, take classes, and gain experience for your future career in psychology. With graduation from a master’s or doctoral program in the U.S. comes new opportunities, excitement, and … worry about repaying your loans. Student loans can seem like a daunting obstacle to overcome, especially as a brand new graduate. What you may not know is that there are many federal programs designed to help support recent graduates in psychology. Keep reading to learn more about these loan repayment options!

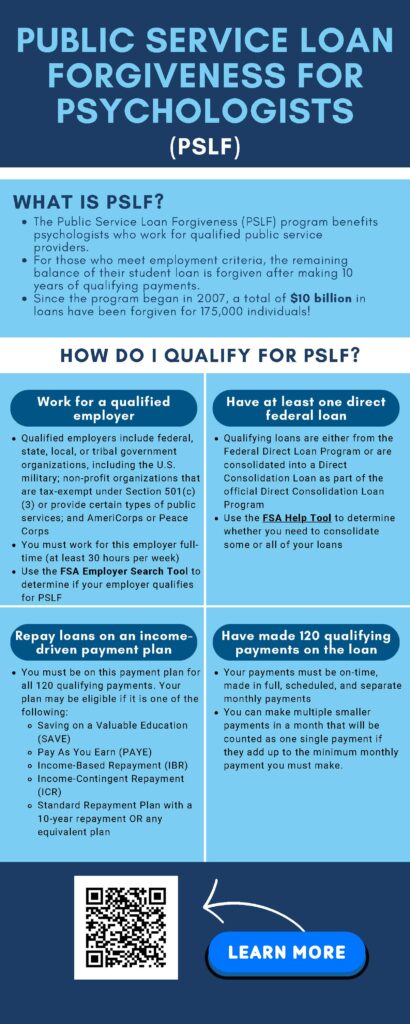

Public Service Loan Forgiveness (PSLF)

The Public Service Loan Forgiveness (PSLF) program benefits psychologists who work for qualified public service providers. For those who meet the employment criteria, the remaining balance of their student loan is forgiven after making 10 years of qualifying payments. Since the program began in 2007, a total of $10 billion in loans have been forgiven for 175,000 individuals. There are many eligible qualified public service providers, such as government groups and certain non-profit organizations.

Heads up! In October 2022, the Limited PSLF Waiver Opportunity expired. As of October 31, 2022, certain types of payments or loan types will no longer be counted towards PSLF repayments. However, additional changes, providing more flexibilities for PSLF eligibility, went into effect in July 2023. More information about the specific changes to PSLF policy can be found here and here.

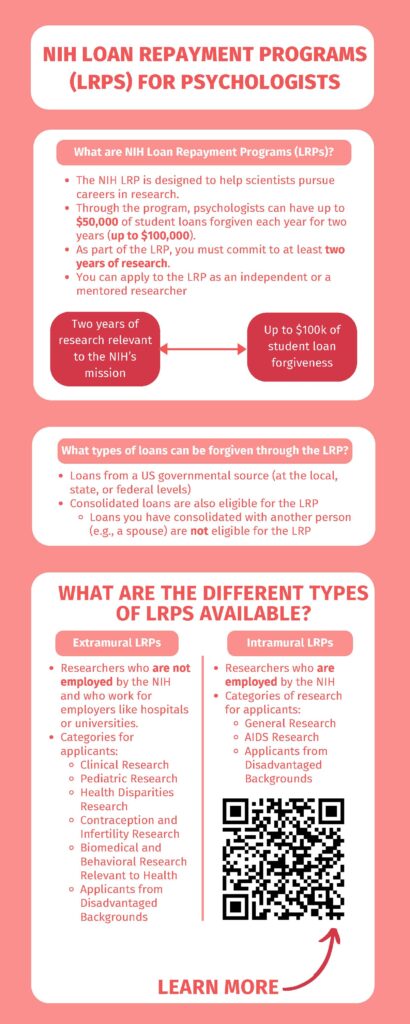

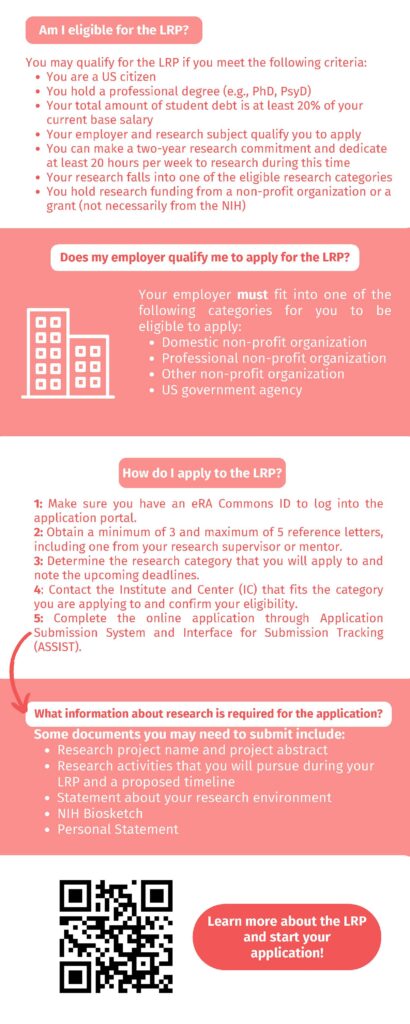

NIH Loan Repayment Programs (LRPs)

The NIH LRP is designed to help scientists with doctoral-level degrees pursue careers in research. Through the program, psychologists can have up to $50,000 of their student loans forgiven each year for two years (up to $100,000). In exchange, you must commit to at least two years of research. You can apply to the LRP as an independent researcher or a mentored researcher.

Health Resources and Services Administration Loan Repayment Programs

HRSA has a number of loan repayment programs that include behavioral health professions such psychologists. Several of them are through the National Health Service Corps, under which health service psychologists are an eligible professional.

The links below include all of the loan repayment programs for which behavioral health professions are eligible.

- NHSC Loan Repayment Program

- NHSC Substance Use Disorder (SUD) Workforce LRP

- NHSC Rural Community LRP

- Faculty Loan Repayment Program

- Pediatric Specialty Loan Repayment Program

Learn more about managing student debt through other APA resources:

- The Student Loan Forgiveness and Repayment Landscape: Updates on Recent Changes to Key Programs

- Student Loan Forgiveness Programs: Success Stories & Advocacy

- The NIH Will Pay Off Your Loans – Here’s How!

- 4 Steps for Public Service Loan Forgiveness

- Which HRSA Loan Repayment Program is Right for Me?

- Advocating for various pathways to student debt relief

About the author: Megha Nagaswami, M.A., is a doctoral student in clinical psychology at the University of California, Los Angeles. She has been a member of the APAGS Advocacy Coordinating Team (ACT) since 2022. Please contact Megha if you have any questions about this blog post or about the Advocacy Coordinating Team.